The long-term viability of any operator-supplier relationship hinges on its ability to create real value and achieve stability. However, the operator benefits from discounted prices, and the supplier benefits from long-term contracts. Reshuffling responsibilities or signing long-term contracts alone does not necessarily add any real, substantive value. Without improvement in the execution of the service, the industry is no richer. This is much like dividing up a pie. With a conventional alliance, the partners merely change the size of the slices of the pie. Slicing the pie differently does not create more pie (i.e., more value). Only increasing the size of the pie creates additional value.

This Tip of the Month dives into a study on how technical process integration (TPI) positively impacts supplier relationships and discusses seven best practices for implementing TPI at your company. The study included 17 alliances and revealed that TPI adds real value and creates stability in the operator-supplier relationship. The study focuses on the drilling within the overall project development program, but is applicable to all services acquired through the project supply chain.

Based on the study performed, the most central finding is that "process definition and linking add demonstrable real value. It does so by reducing costs and speeding up production." In other words, the most effective way to form an alliance is through a detailed description and improvement of the technical processes involved. The parties in the process-driven alliance are linked together with:

- A common set of technical processes

- Mutually defined bottom-line goals

- Shared benefits

Improving the technical process – not the service designations (e.g. carving up the pie) – is the focus of the relationship.

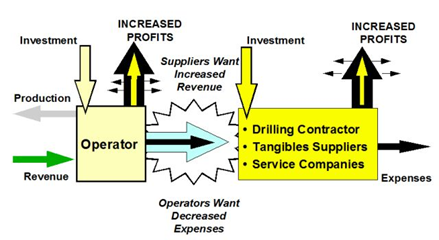

As shown in Figure 1, operator and supply/service company profit motives are often on a collision course. Operators want good service at a low price, and suppliers want a higher price. In fact, viewed in this way the relationship is a zero-sum game: if one party wins, the other loses. This tension explains the source of the conflicting relationship that can exist in conventional drilling business contracts.

Figure 1 The Zero-Sum Game.

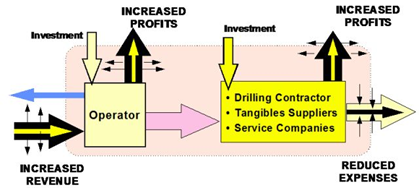

The GRI study found about 50% of the alliances are driven by the structure of the commercial terms, not the technical processes. None of the commercial structure driven alliances were able to demonstrate quantified upgrades in performance. Figure 2 shows that simply putting partners together does not address the basic issues of creating real value and achieving stability. Focusing solely on commercial terms is just cutting the same pie differently. The study showed that the goal of the most successful alliances was not to craft commercial relationships between the parties, but to create real value.

Figure 2 Sources of Real Value.

As shown in Figure 2, real value is created only if supplier expenses are reduced and/or if the operator's revenue increases (either by increased or accelerated production). For an alliance to create real value, it must increase the size of the pie. For a drilling alliance this means either creating more value from the resource, creating the value at a reduced cost to society, or both.

The most successful alliances understand how joint process improvements reduce total system expense and cycle time required to bring new production online. As a result, net present value (or NPV) of the revenue stream increases. This can only happen with a detailed grasp of how technology can be applied to achieve these process improvements. Real value is rarely created through a large "breakthrough" improvement; real value is created by working within the technical and planning process to find a large number of small efficiency improvements.

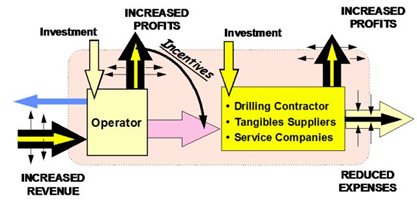

Creating value is not enough if the relationship is unstable. Suppose the operator reduces expenses by improving the joint processes but does not share rewards with the suppliers and service companies. Then the suppliers and service companies will receive reduced profit as the reward for their increased efficiency. Any service provider whose fee is based on time will make less per well as efficiency increases. Without adding incentives, such relationships will only be stable if the service provider does not have any other, more attractive choices for work.

As one operator of a successful alliance related to the GRI team, "All partners must agree that an alliance is not a discount. Instead, they must recognize that the partners will make greater profits through incentives by reducing the operator's costs." Increased efficiency must be in every player's self-interest. As shown in Figure 3, this means that the benefits of the value generated should be shared with suppliers or the relationship will be unstable.

Figure 3 The Importance of Stability (True "Win/Win").

From the study, we recommended seven success factors for technical process integration (TPI).

TPI SUCCESS FACTORS

The researchers discovered seven factors to be essential when creating successful TPI alliances. For this study, levels of success were assigned based on interviews held with the partners within each alliance. This provided a method of relating the success factors to the "reported" success of each relationship. The results revealed alliances that emphasized the same certain factors were more efficient.

7 SUCCESS FACTORS

1. Mutual Goals

All partners must have clearly defined mutual goals. This ensures they understand what each party wants and requires from the relationship.

2. Goals Linked to Profits

In addition to being defined, goals must be tied to profit. If the venture will not be profitable to all partners, it should be redesigned.

3. Well-Defined Process

Expanding the project’s goals to include all steps required in the drilling process is the function of process mapping. This stage requires enough detail to ensure all steps that do not add value are removed from the process, improving profit. All partners must work together in this exercise from the beginning. In addition, the partners need to step outside the “box” of normal roles and permit room for new assignments.

4. Buy-In at the Right Levels

Approval must be obtained from each partners’ senior management and buy-in must be encouraged for all involved. Buy-in means more than informing employees; it includes soliciting their ideas and helping them adapt to the new corporate culture.

5. Quantitative Performance Measurement Tools

A possible downfall of relational-driven alliances is that people skills are subjective and difficult to measure. Specific, performance related tools are needed to measure the success of the results against the goals established at the onset of the project.

6. Performance Based Incentives

An important success factor is detailing the incentives to be awarded to the partners and the benchmarks to which those incentives are tied.

7. Process Improvement Analysis

Successful alliances build methods to analyze performances throughout the process.

This includes ensuring that analysis is tied to the original goals, learning through continuous improvement and documenting the knowledge, maintaining a proactive rather than a reactive posture, and focusing on the process. Numerous feedback loops are built into the process to enhance communications and help retain learning. This is a critical aspect of an alliance: the ability to rework an alliance when technical changes occur.

Summary

In conclusion, the findings of this study show that successful alliances integrate technical processes throughout their relationship. The integration includes clearly and concisely defining the process, accurately and realistically quantifying each process component, finding and prioritizing improvement opportunities, and jointly operating to achieve maximum results for the process. In addition, successful alliances analyze their processes in an ongoing manner, building feedback and improvement into the process maps.

If you would like to learn more about managing supplier relationships or technical process integration, we recommend enrolling in a session of Petroleum Project Management or one of our other project management courses!