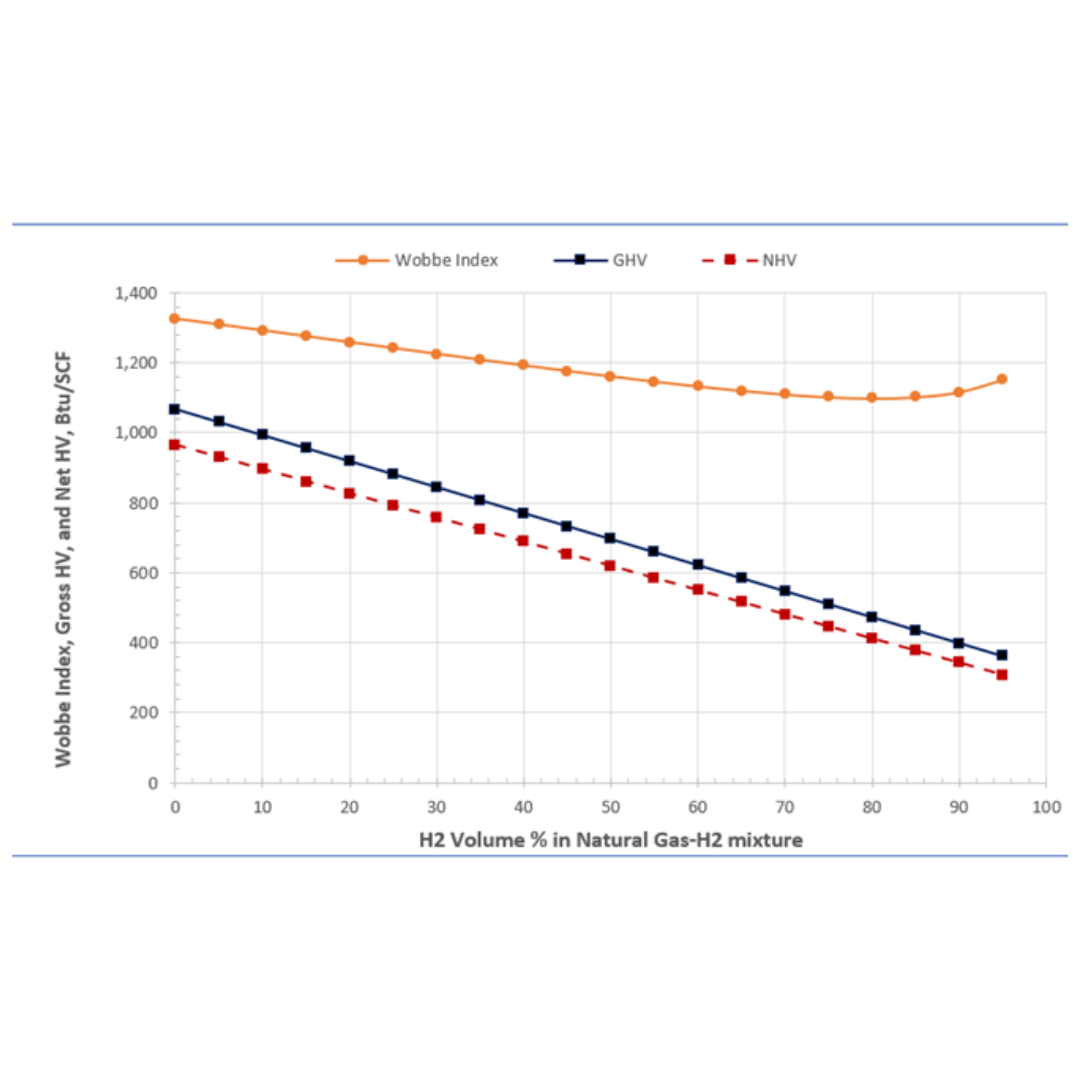

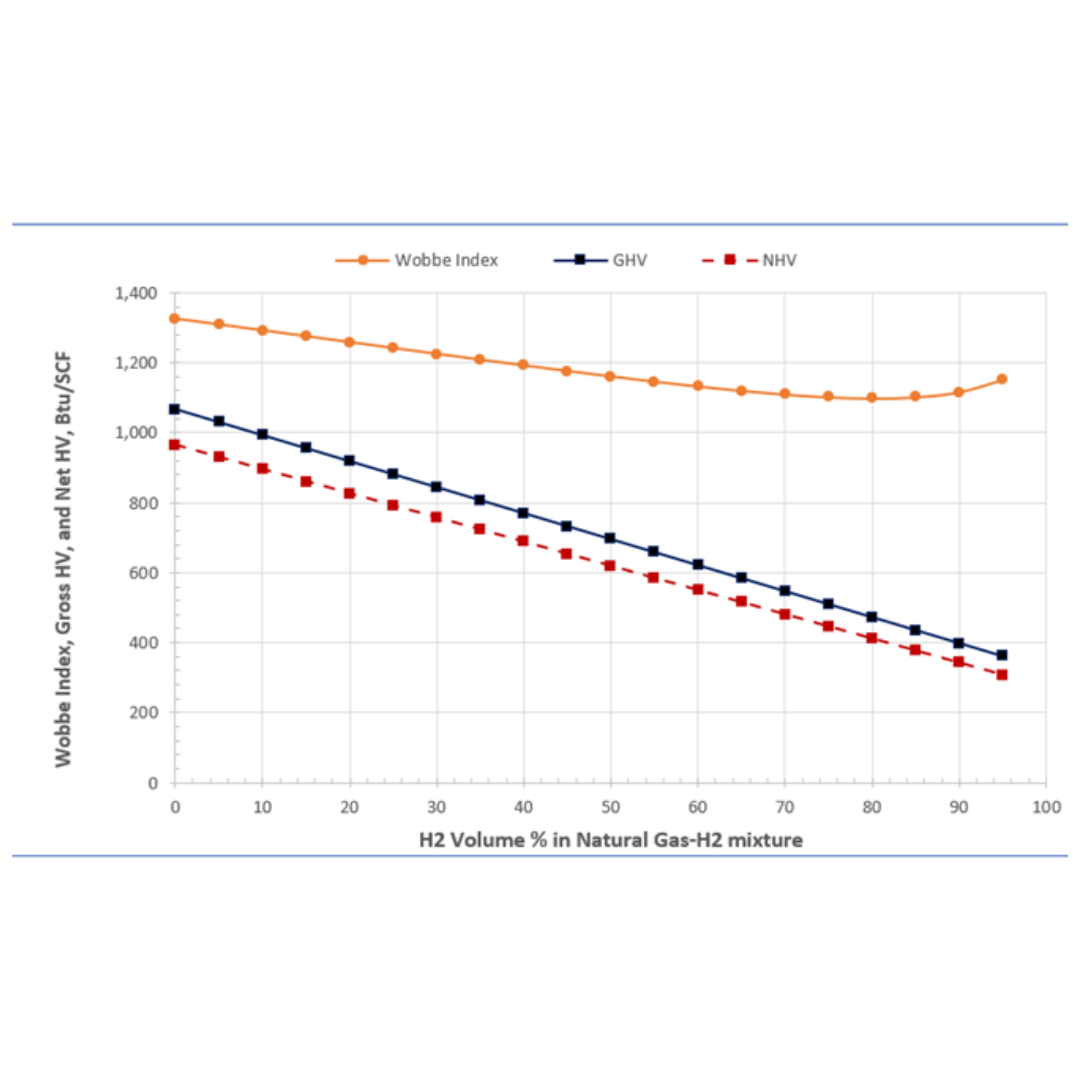

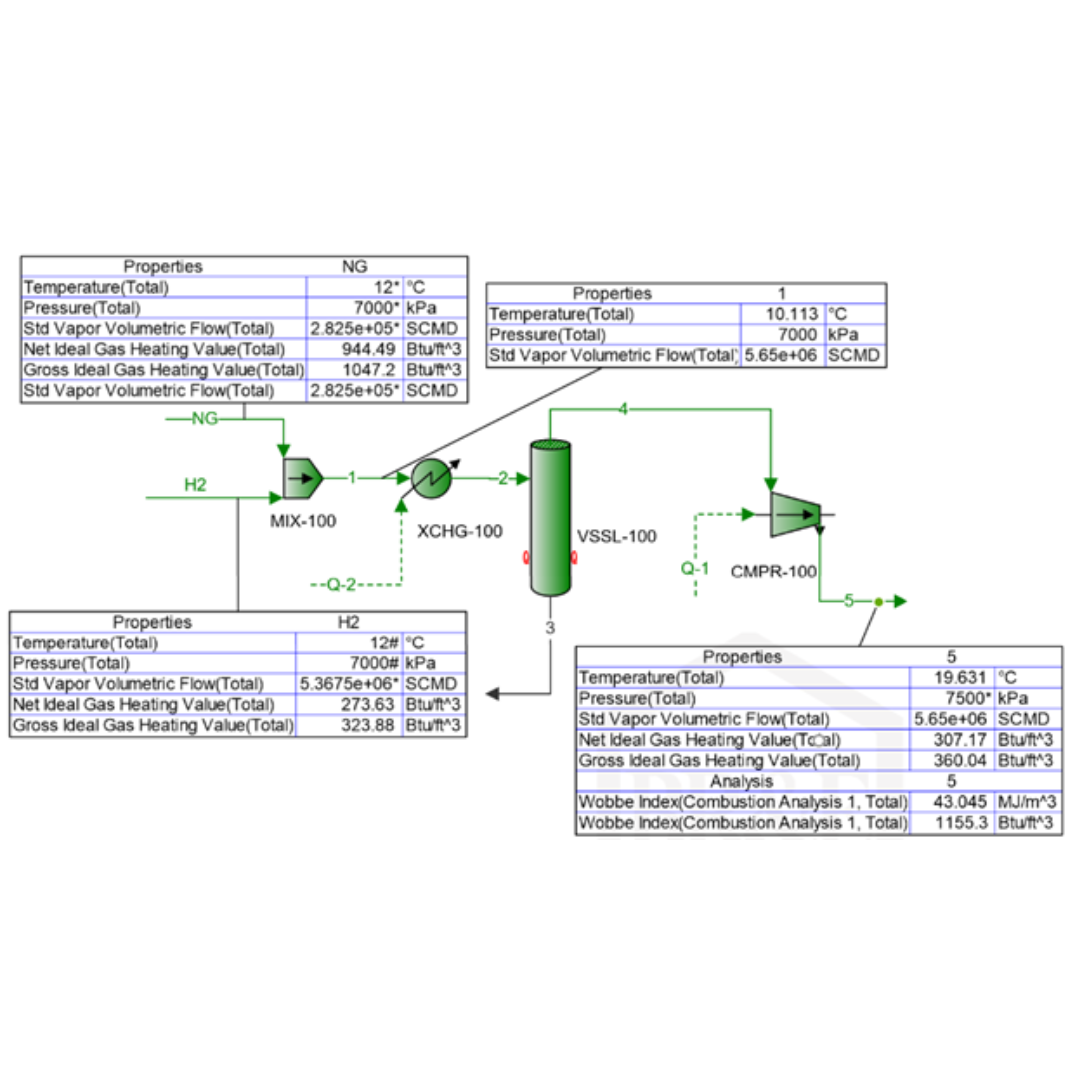

Hydrogen Series Part 3: Hydrogen compression and transportation by transmission pipeline – What are the impacts of Hydrogen blending on the physical properties of hydrogen and natural gas?

In continuation of Feb and Mar 2023 “Tips of the Month” (TOTM) and given the amount of investment and interest in hydrogen, we have decided to publish a series of TOTM to explore the opportunities, challenges, and potential solutions to hydrogen applications and uses; this is the third paper in the series. In this TOTM we will review the physical ...

View Article

The Long Road Ahead; Opportunities and Challenges in U.S. LNG Export Development

After an extended period of low U.S. benchmark Henry Hub natural gas prices, many gas producers would welcome build-out of U.S. LNG export facilities. The global demand for U.S. sourced LNG remains strong, and Henry Hub indexed LNG is very competitive globally. LNG exports are expected to be the largest driver for lower 48 demand growth over the ...

View Article

Hydrogen Series Part 1: Hydrogen Colors – What do they mean, Options for Production and their associated Challenges? (Spanish Translation)

April 11, 2023

|

Tip of the Month

Producción baja o ninguna producción del Hidrógeno Carbono, su distribución y consumo se ha considerado una de soluciones primarias para lograr un cero neto para la Industria pesada, posible generación de potencia, uso residencial para cocinar, así como el transporte. El hidrogeno posee un valor alto de capacidad de calor, y cualquier reacción de c...

View Article

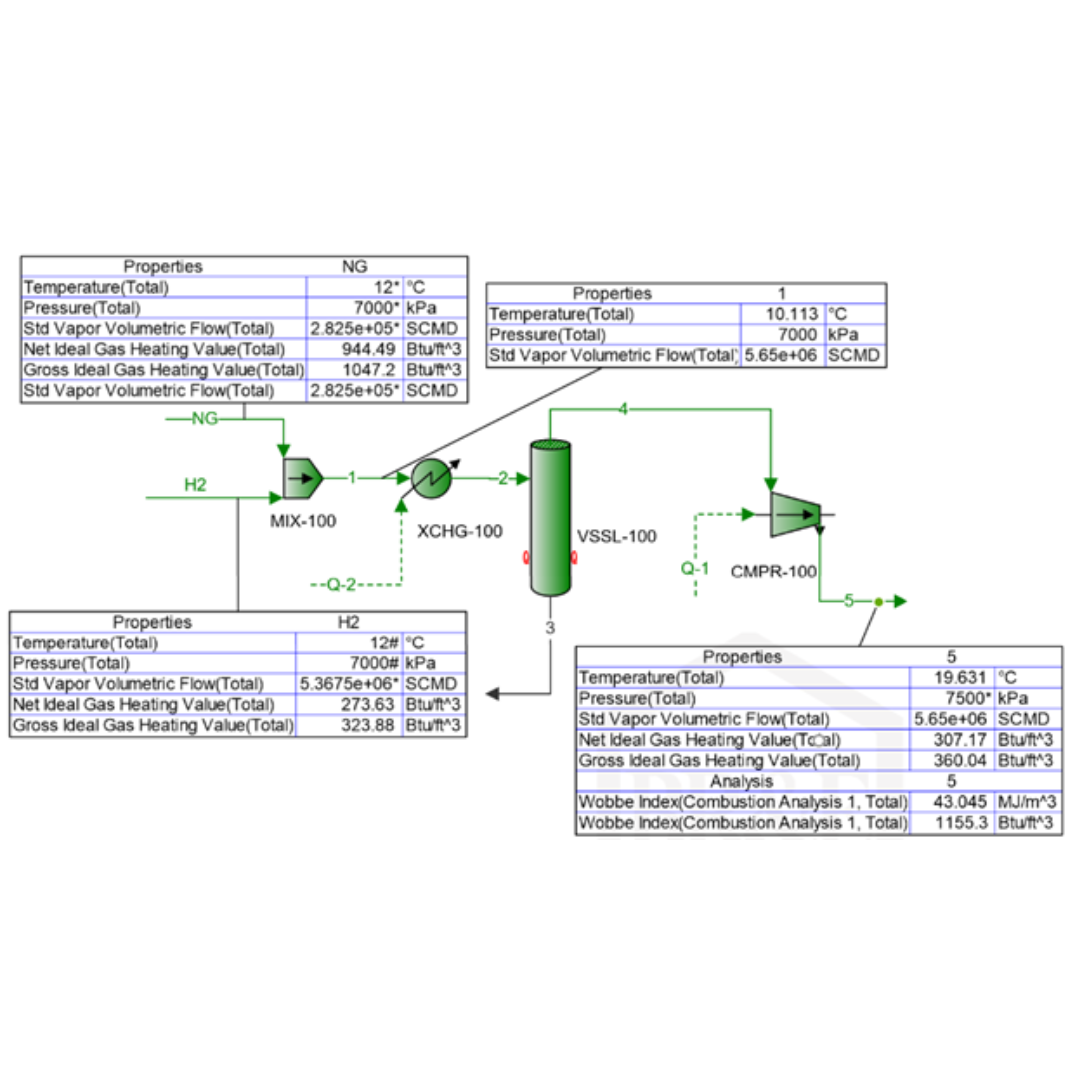

Hydrogen Series Part 2: Hydrogen compression and transportation by transmission pipeline – What are permissible conditions and limitations and their associated challenges?

March 1, 2023

|

Tip of the Month

In continuation of Feb 2023 “Tips of the Month” (TOTM) and given the amount of investment

and interest in hydrogen, we have decided to publish a series of TOTM to explore the opportunities,

challenges, and potential solutions to hydrogen applications and uses; this is the second paper in the series.

As such, we will continue this exploration with h...

View Article

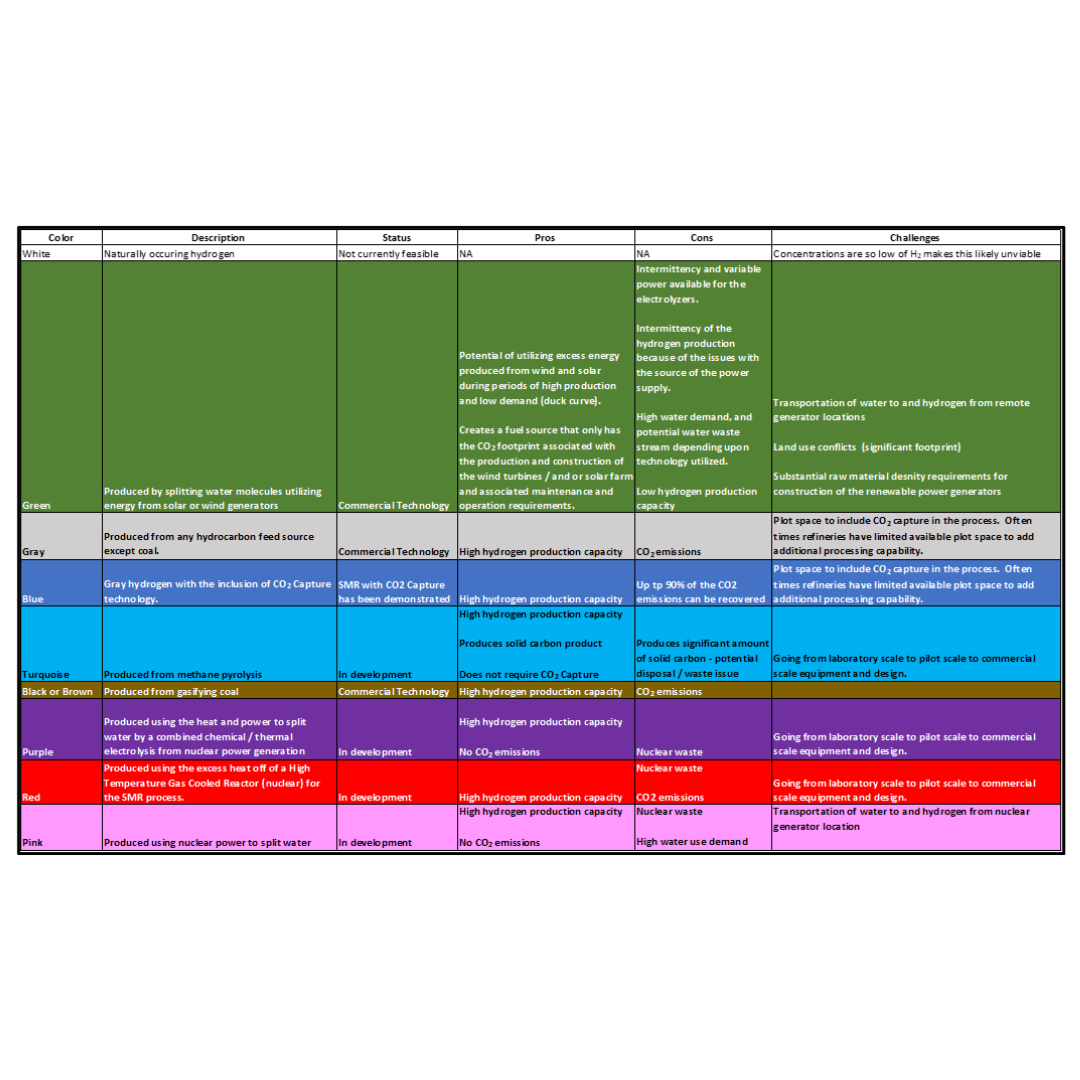

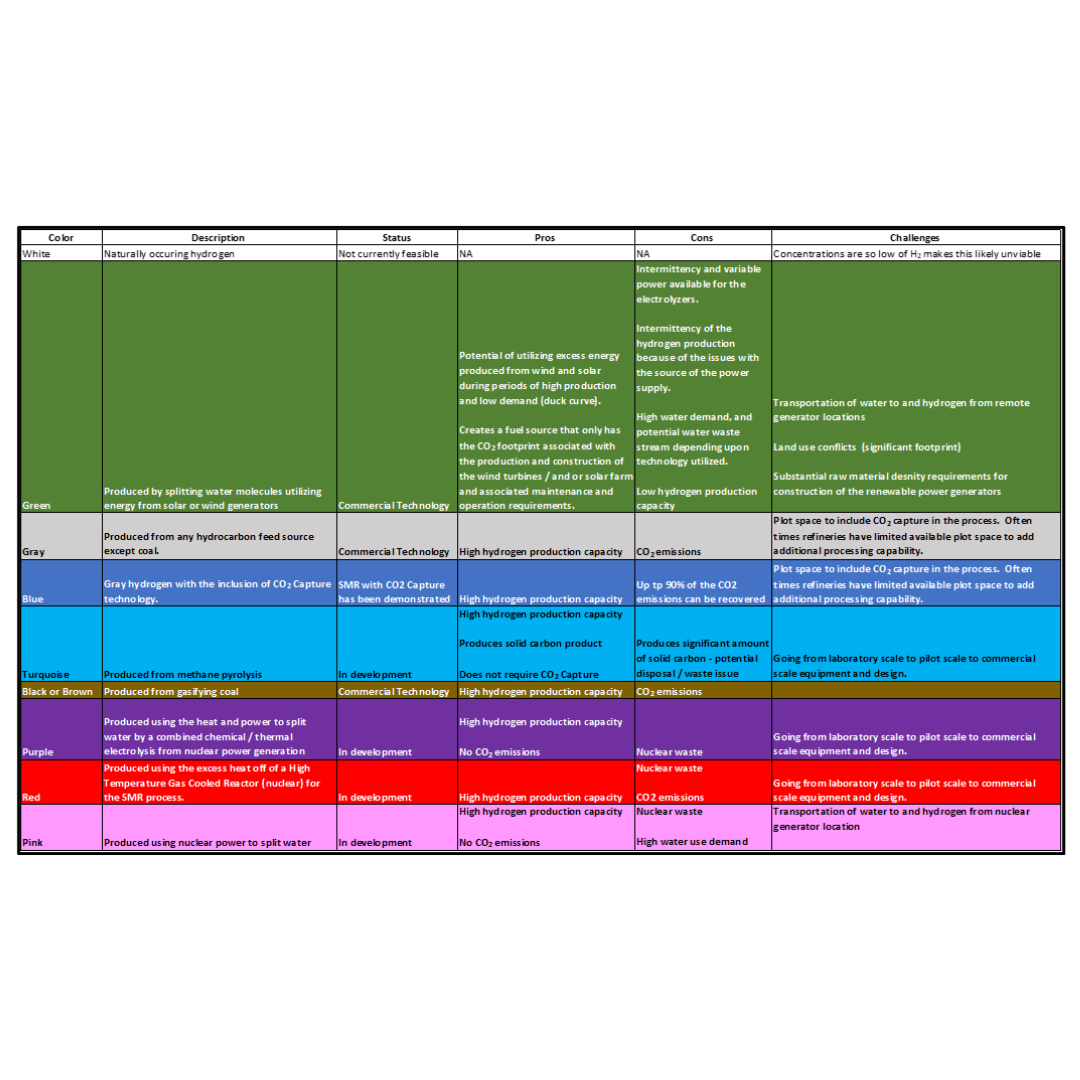

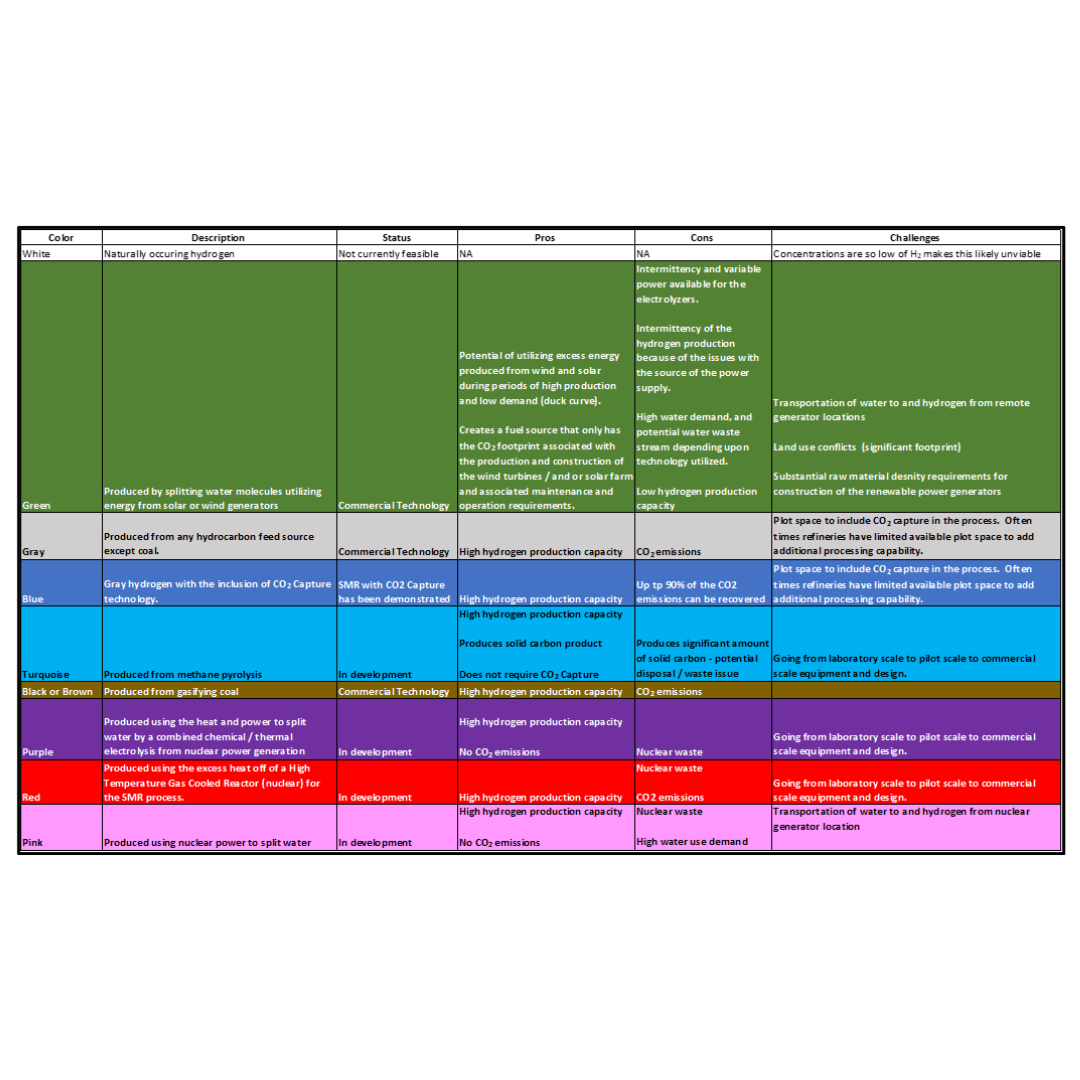

Hydrogen Series Part 1: Hydrogen Colors – What do they mean, Options for Production and their associated Challenges?

February 15, 2023

|

Tip of the Month

Low or no carbon hydrogen production, distribution and consumption is thought to be one of the primary solutions to reaching net zero for heavy industry, possibly power generation, residential use for heating and cooking, as well as transportation. Hydrogen has a high heating value, and the combustion reaction does not produce CO2. According to H...

View Article

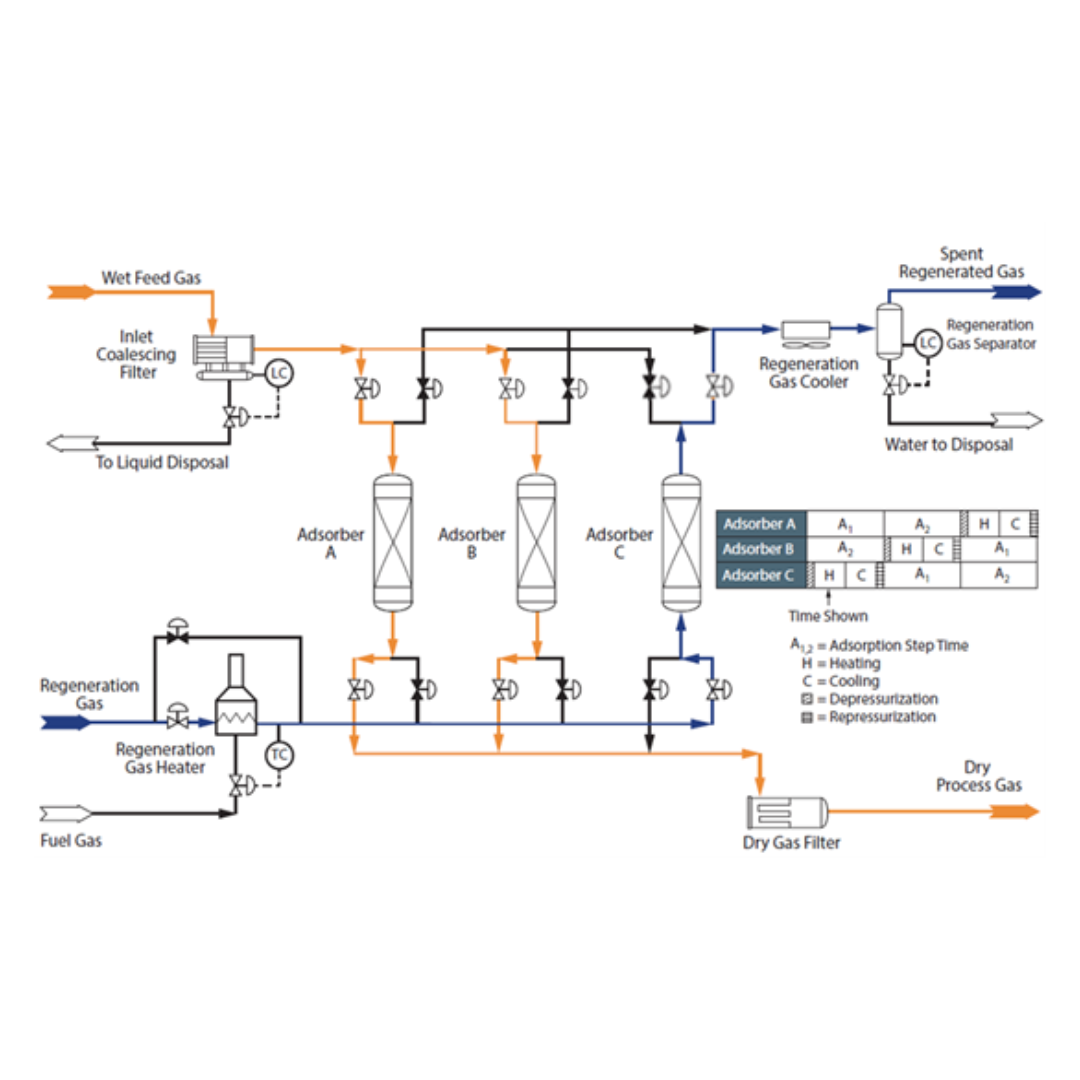

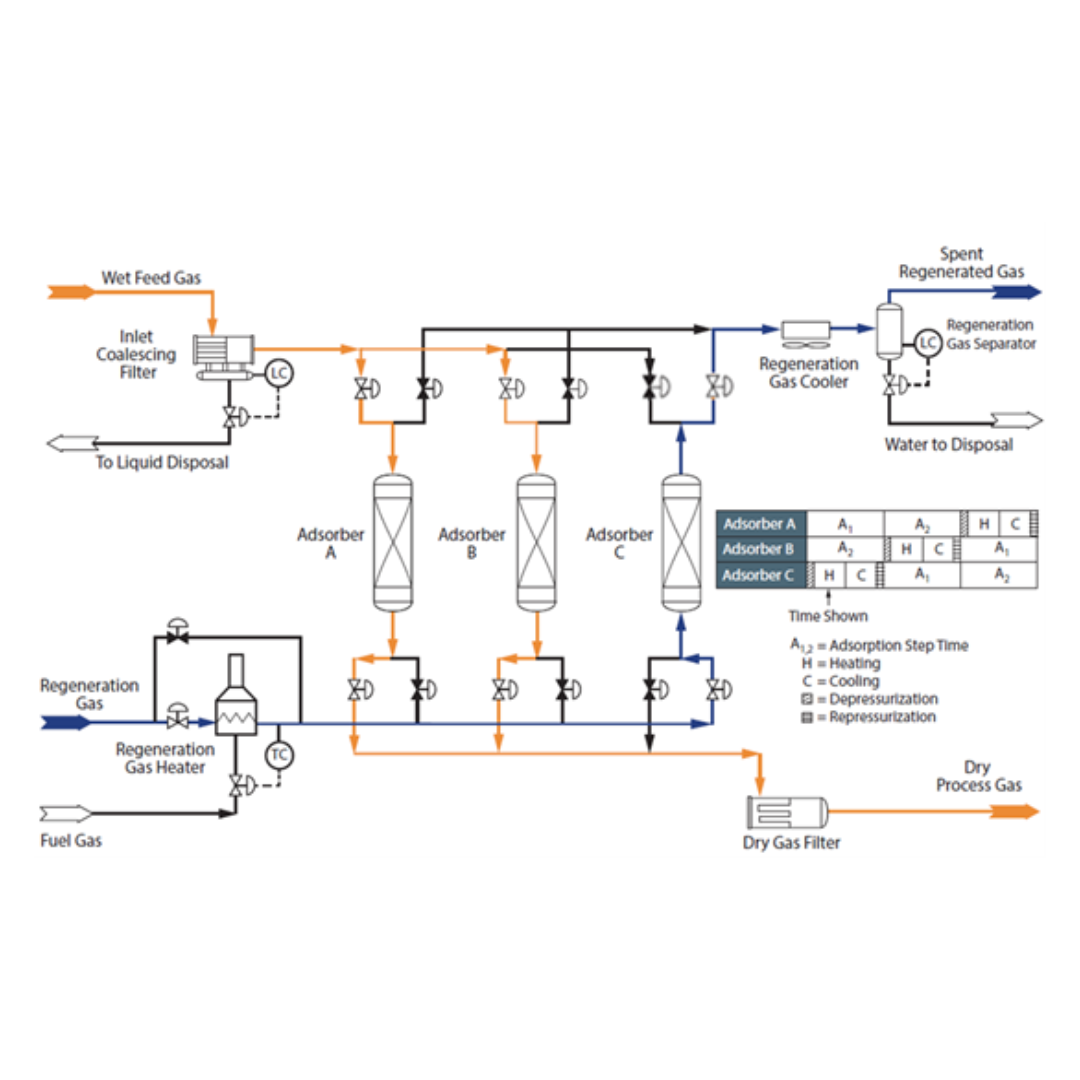

A Short Cut Method for Evaluating Molecular Sieve Performance

February 2, 2023

|

Tip of the Month

This Tip of the Month shows how a Short Cut Method (SCM) after one Performance Test Run (PTR) may be used to estimate the life of a Type 4A molecular sieve dehydrating a water-saturated feed of natural gas.

The results of the proposed SCM have been compared with the rigorous manual calculations (May 2015 Tip of the Month) and the computer-generate...

View Article