How to Build a Business Case for Project Management

Creating a business case for project management is similar to creating a business case for anything—with one subtle difference. Creating a business case for a factory, or real estate investment requires an understanding of how physical assets impact cash flow. We need to ask questions like:

What will the plant cost?

How much can it make?

What will its products be worth?

To make a business case for investments in project management, as opposed to physical assets, we need to understand how project management impacts cash flow. This opens up a different set of questions:

What will it cost to properly manage a project?

How much better will we perform with improved project management?

What will the performance be worth?

To make sound decisions about investments in project management, your organization needs a business case that tests how managing projects will add to the fundamental value-generating activities. This Tip of the Month gives you a four-step process that you can use to build your own business case at your company. The four steps include:

Build Your Business Case

STEP 1—INVENTORY YOUR PROJECT ACTIVITIES

The first step is to inventory your organization’s typical types of project activities. Some real examples of these might include: re-completing a well, conducting a reservoir study, drilling a well, building an offshore platform, or conducting an exploration program. Each activity involves an upfront investment in anticipation of a future income. Most organizations have many such activities.

STEP 2—QUANTIFY BUSINESS CASH FLOW PROFILES

The second step is to quantify how each of these activities yields a positive economic return for your organization. To really understand how activities link to value, each activity’s full cycle economics must be understood and described.

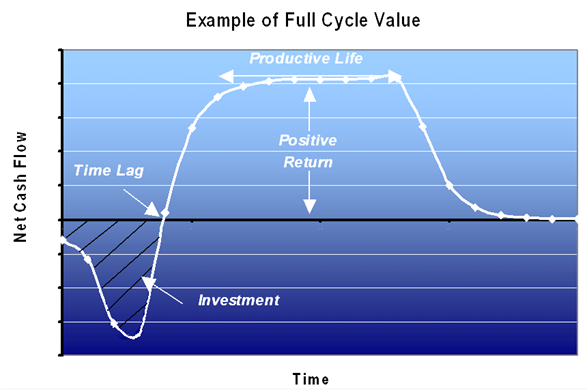

Each activity will have its own typical cash flow profile. You will need to be able to plot the before improvement cash flow versus time for each core activity. The full-cycle economics for any project includes the following data and would exhibit a similar pattern to the example shown in Figure 2.1:

-

- Investment - e.g., Resources required to run seismic, construct a platform, or drill a well.

- Time Lag - e.g., Time required to analyze, build, or drill.

- Positive Return - e.g., Income exceeds cost as return is achieved.

- Productive Life - e.g., Period of time until production declines.

Fig. 2.1 Example of Full Cycle Value

STEP 3— DETERMINE THE ADDED VALUE OF IMPROVED PROJECT MANAGEMENT

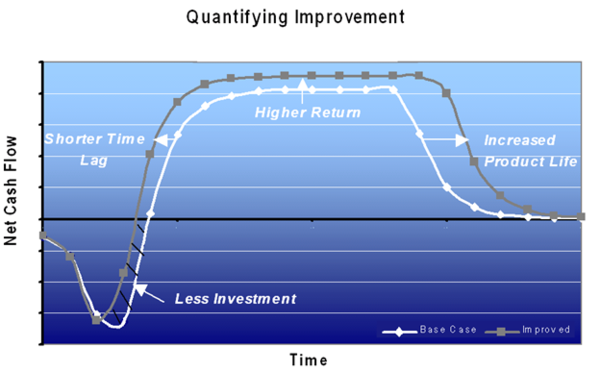

The third step is to develop an understanding of how improving project management could increase key activity value. To do this you must calculate, with reasonable certainty, how project management would improve each activity’s cash flow profile. You must also be able to answer the question, “How will better project management decrease each activity’s investment, reduce time lag, and/or increase its positive return or productive life?”

Project management investments should be evaluated using the same full-cycle economic criteria outlined in step two: investment, time lag, profit, and productive life. Examples of the impact that project management efforts will have on each of these criteria are:

- Investment - e.g., How will better goal alignment, risk management, and coordination decrease the cost and waste?

- Time Lag - e.g., How will better scheduling and resource allocation reduce the time to get work done?

- Positive Return - e.g., How will better goal definition and execution make wells more productive?

- Productive Life - e.g., How might a better involvement of the right people, and risk management lengthen a given reservoir’s life?

Figure 2.2 shows an example of a baseline and improved cash flow profile.

Productive Life

Figure 2.2 Quantifying Improvement

STEP 4—CALCULATE THE NET VALUE OF INCREMENTAL CASH FLOWS

The final step is to calculate the net value of your knowledge management improvement by predicting project management effort’s costs and value. Estimating an effort’s cost is relatively straightforward. How much will it cost to develop and implement? What will it cost to run on an annual basis?

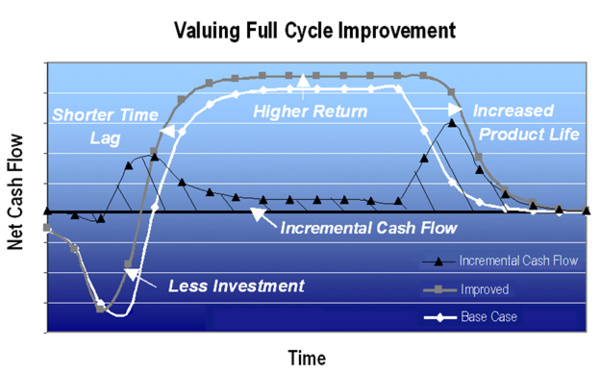

Most project management initiatives make a passing grade in estimating cost, but many fail at estimating value. Given the estimates of how project management affects your organization’s cash flow profile, it will be relatively easy to quantify the effort’s value. Project management is worthwhile when the incremental cash flow between the “Business as Usual” and the “Better Project Management” case more than justifies the cost of the effort, as demonstrated in Figure 2.3.

This figure shows how relatively simple improvements in the cash flow profile can result in huge returns from the knowledge management effort as a whole. The “Knowledge Value Calculator” is a simple-to-use tool that is based on this approach can help you quantify the value of knowledge management and is available on the CD that accompanies this course. The tool will teach you to value knowledge management and explore three example situations: a management change effort, software development process, and an oil field development. These examples show that returns on knowledge management investments can realistically be 300 to 500%!

Productive Life

Figure 2.3 Valuing Full Cycle Improvement

A REAL EXAMPLE—LARGE SCALE FRANCHISE EXPANSION

Consider one real-life case. An organization was trying to quickly locate, acquire, permit, zone, design, construct, and commission about 1500 franchise sites throughout the United States in three years. Previously, the organization only managed to add 40 sites per year. Adding 500 per year was a challenge that they were having difficulty accomplishing. There were cost overruns, quality problems, and schedule delays—all from preventable problems.

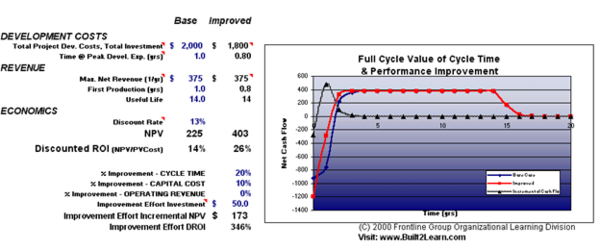

Figure 2.4 shows how improved knowledge management resulted in huge returns for the effort as a whole through relatively small improvements in performance.

Figure 2.4 Time and Performance Improvement

These projects typically cost $2,000,000 each. By creating a method to share best practices online throughout approximately 40 teams, the company was able to reduce the investment by 10% (saving $200,000), and the time lag by 20% (reducing cycle time per project from 12 to 9 months). Every team member was able to know the latest and best practices for locating, acquiring, zoning, permitting, designing, constructing, and commissioning each site. With no improvements in return or product, this increased the NPV of each site by approximately $173,000 or 57%. More importantly, the $50,000 average cost per site for development and implementation of the effort meant that the return on the investment in this Project Management effort was worth over 300%!

To learn more about petroleum project management and how to build a business case, we recommend enrolling in an upcoming session of Petroleum Project Management: Principles and Practices.